Last week, the Satellite 2020 Conference & Exhibition wrapped up after four days of presentations and addresses from some of the leading experts in the telecommunications industry. As advertised, SpaceX founder Elon Musk was on hand to deliver a keynote speech in which he announced that (contrary to earlier statements) Starlink will not be spun off and become its own business enterprise.

This comes a little over a month and a half after Gwynne Shotwell, the President and Chief Operations Officer (COO) of SpaceX, stated during a private investor event that the company was considering spinning Starlink off and making it a publicly-traded company. But as Musk stated at the conference in Washington, D.C., SpaceX is too busy "thinking about that zero" to take the company public right now.

This decision is likely inspired by previous telecommunication companies that attempted to deploy large satellite constellations only to go bankrupt - which include Iridium, Globalstar, Orbcomm and Teledesic. All of these companies, save Teledesic, managed to recover in time with the deployment of second-generation constellations.

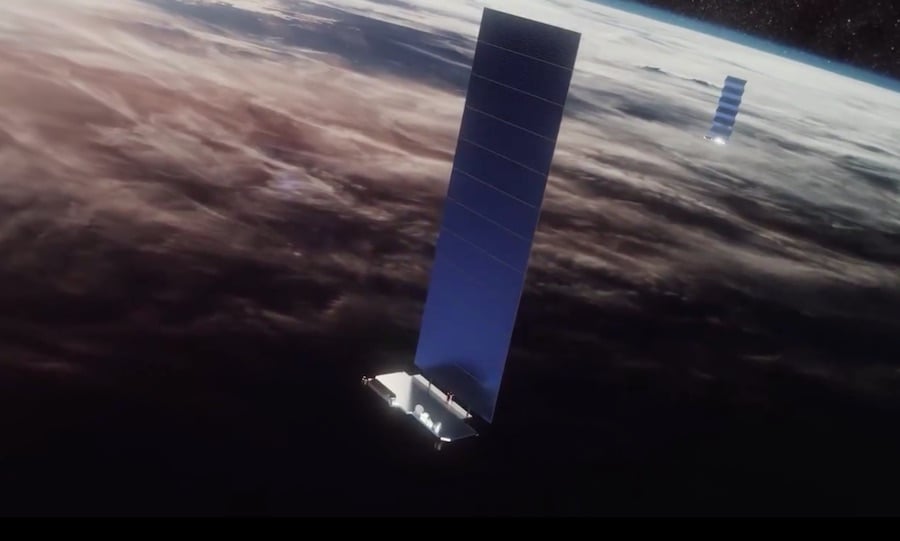

However, Starlink is still in the process of deploying its first constellation, which currently consists of 300 satellites in Low Earth Orbit (LEO) - but is scheduled to reach 1,584 by 2024 and 2,200 by 2027. Ultimately, Musk has stated that he hopes to create a constellation of 12,000 satellites. Based on SpaceX's most recent filings with the International Telecommunications Union (ITU), it could be as large as 42,000.

At this juncture, Musk says SpaceX needs Starlink as a revenue generator, which has the potential to outpace their launch business in the coming years. All told, commercial launch services are a highly-lucrative and fast-growing industry, accounting for roughly $3 billion in annual revenue in the US alone (based on FAA data from 2017).

SpaceX's share of all the newly awarded commercial launch contracts in 2017 was estimated at 45%, which grew to 65% by the following year. However, Musk estimates that the broadband connectivity market in the US will be worth at least ten times that much. In 2019, the total revenue of the internet service industry reached $687 billion, and the market is expected to reach as high as 74 trillion by 2026.

Much of this growth will be driven by users in the developing world, particularly Asia, South America, and sub-Saharan Africa. Satellite-based broadband internet is key to these projections since it will make access possible in parts of the world where the necessary infrastructure (such as optic cable or phone lines) are lacking. With so much growth projected, Musk is hoping to avoid two things.

First, he wants to avoid competing with established telecommunications providers for the time being. Second, he wants to prevent one of his businesses from going bankrupt. As he put it:

"[Bankruptcy] would be a big step, to have more than zero in the not bankrupt category... Starlink will effectively serve the 3% or 4% hardest to reach customers for telcos, or people who simply have no connectivity right now, or their connectivity is really bad."

The next launch, which sent an additional 60 Starlink satellites to orbit, launched on Wednesday, March 18th. The launch was originally scheduled to take place on Monday but was delayed due to anomalous data readings during the preflight engine check. While the company failed to recover the first stage booster (which was making its fifth flight), the satellites managed to deploy successfully.

A total of five launches have taken place since May of 2019 and by the of 2020 (assuming four more launches will happen by then), the Starlink constellation should number just shy of 600 - double its current size. The company claims that services will be available in the Northern US and Canada later this year, with "near global coverage of the populated world by 2021."

And be sure to check out this video Musk's presentation at Satellite 2020, courtesy of

*Further Reading: SpaceNews*

Universe Today

Universe Today